The Opportunity Pocket in the Home Market

Are you waiting for the “perfect” time to buy a home? Many buyers are watching mortgage rates closely, hoping for a dip before they make a move. But here’s why waiting might actually cost you—and why current market conditions could make this an ideal time to buy.

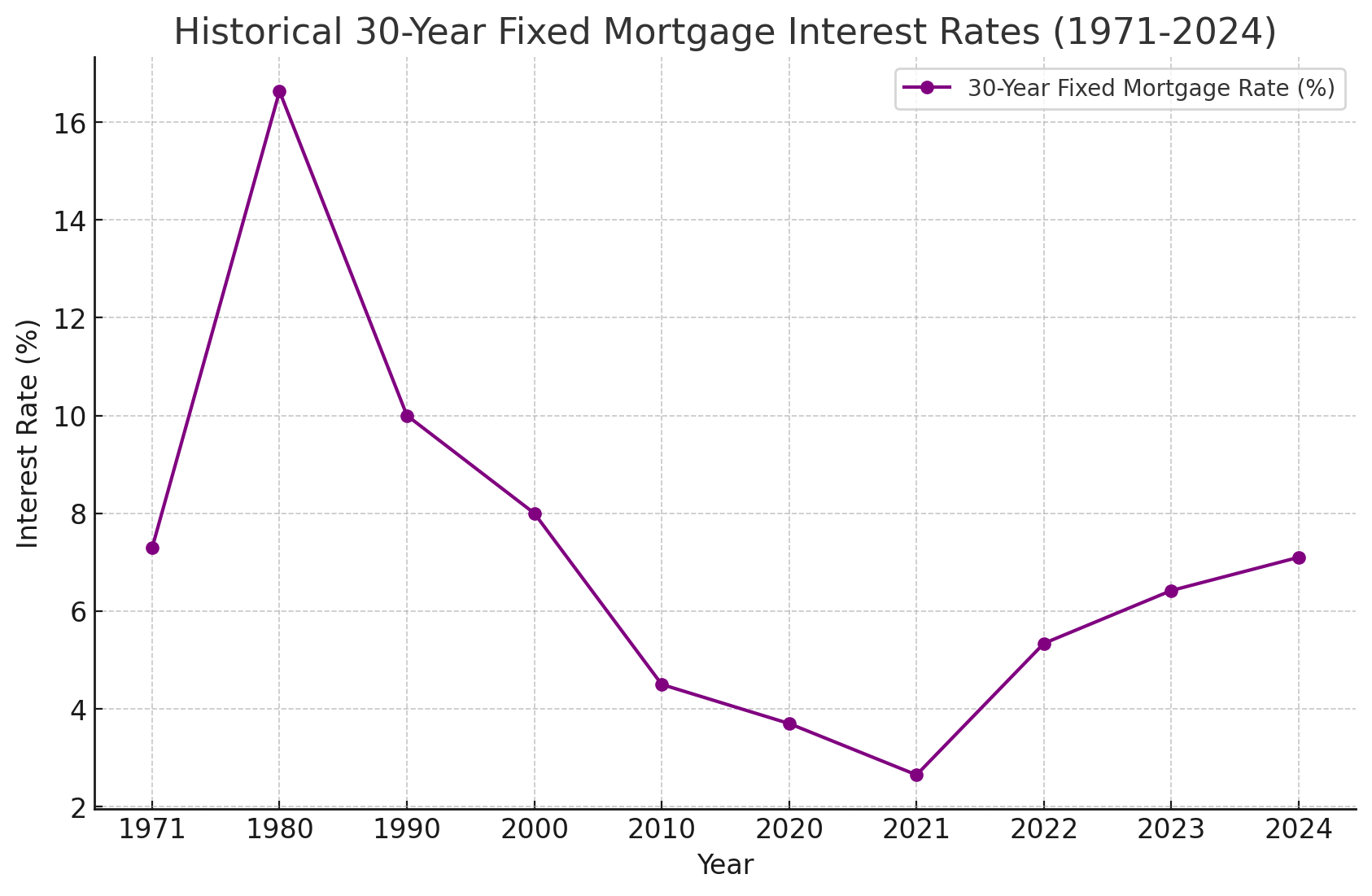

1. Mortgage Rates: A Historical Perspective

Let’s start by looking at where mortgage rates stand today. The 30-year fixed mortgage rate has seen significant changes over the past few decades. In the early 1980s, rates skyrocketed to over 16%! Since then, we’ve seen a gradual decline, and rates even dipped to historic lows during the pandemic.

Today, rates have risen to about 7.1%, which may seem high compared to recent years but is still moderate in the broader historical context. If rates do decrease in the future, it could trigger a surge in buyer demand. Buying now allows you to get ahead of that potential competition and lock in a home before the market heats up again.

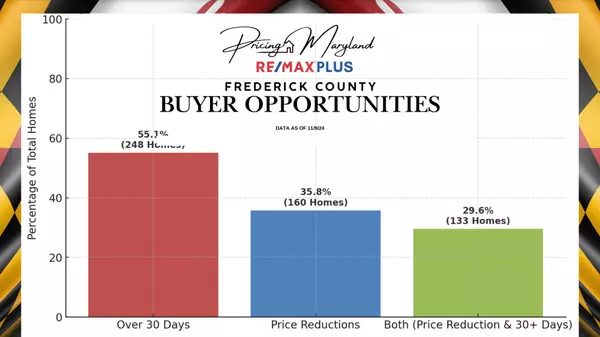

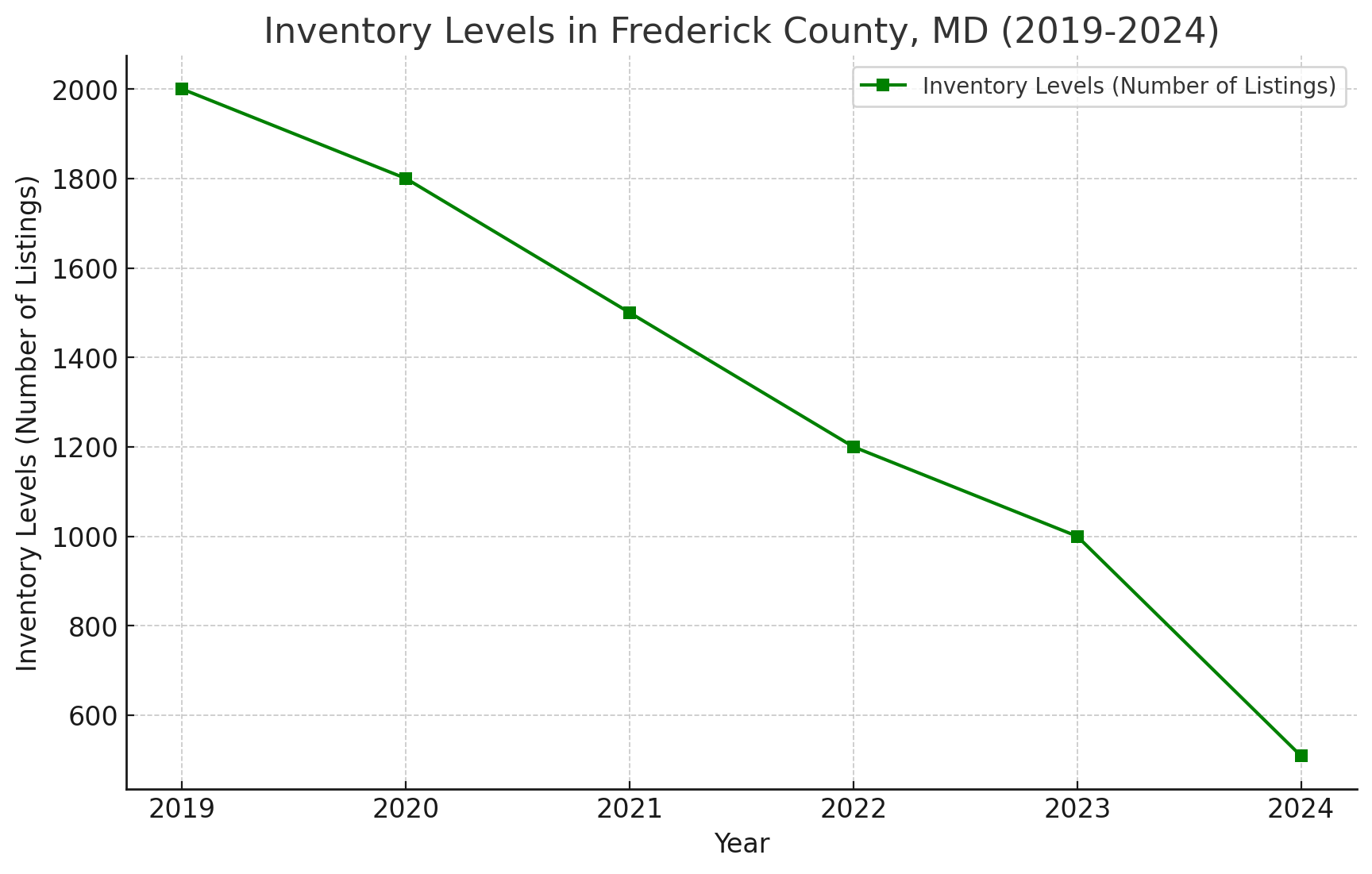

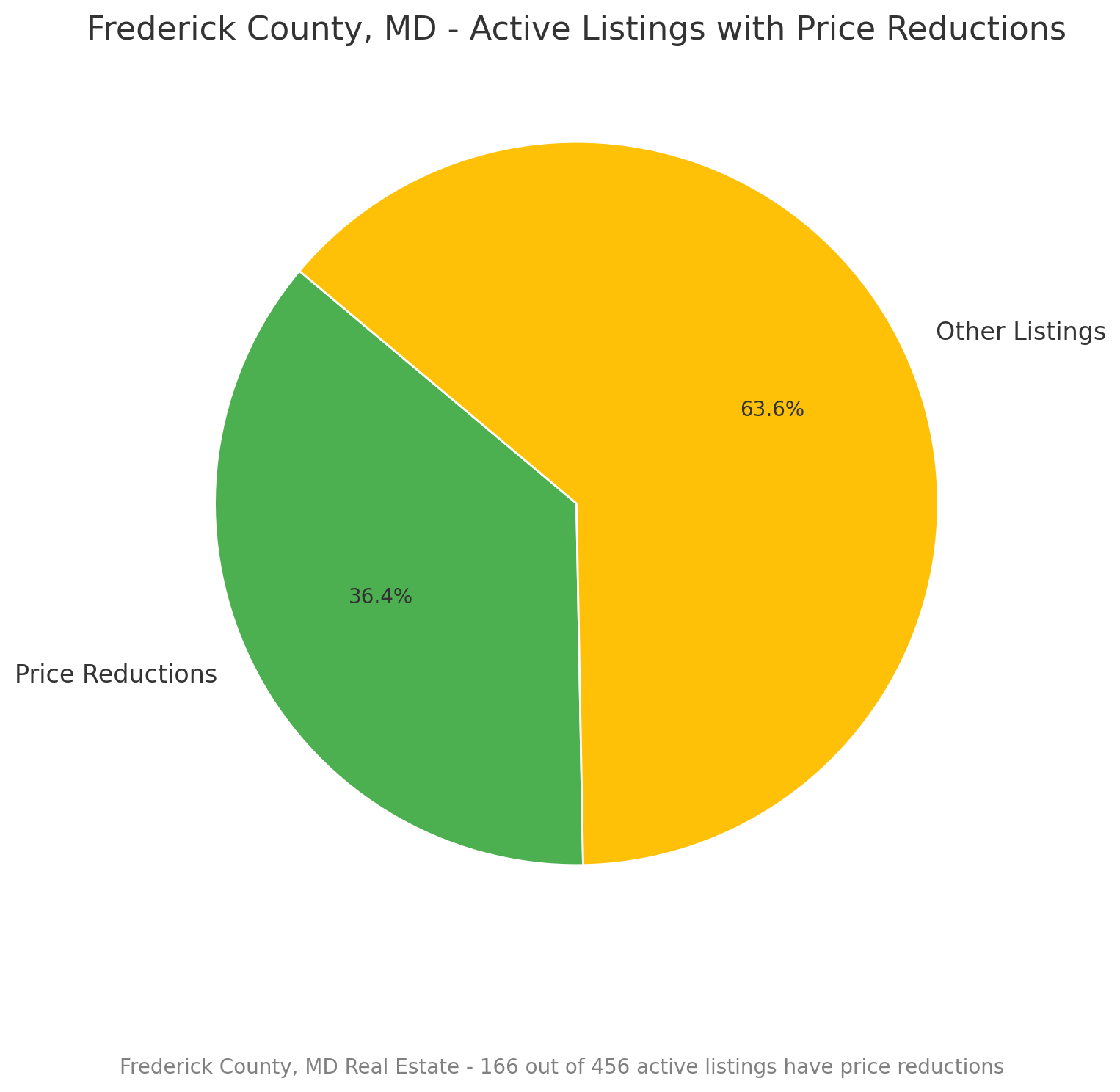

2. Inventory Levels and Price Reductions: More Negotiation Power for Buyers

Low inventory has been a persistent issue in many housing markets, and Frederick County is no exception. Typically, low inventory means high competition among buyers. But right now, the situation is unique.

Of the 456 active listings in Frederick County, approximately 36% (166 homes) have seen price reductions. This means there are motivated sellers who are open to negotiation—a significant advantage for buyers. By purchasing now, you may have the opportunity to secure a property at a better price and with more favorable terms.

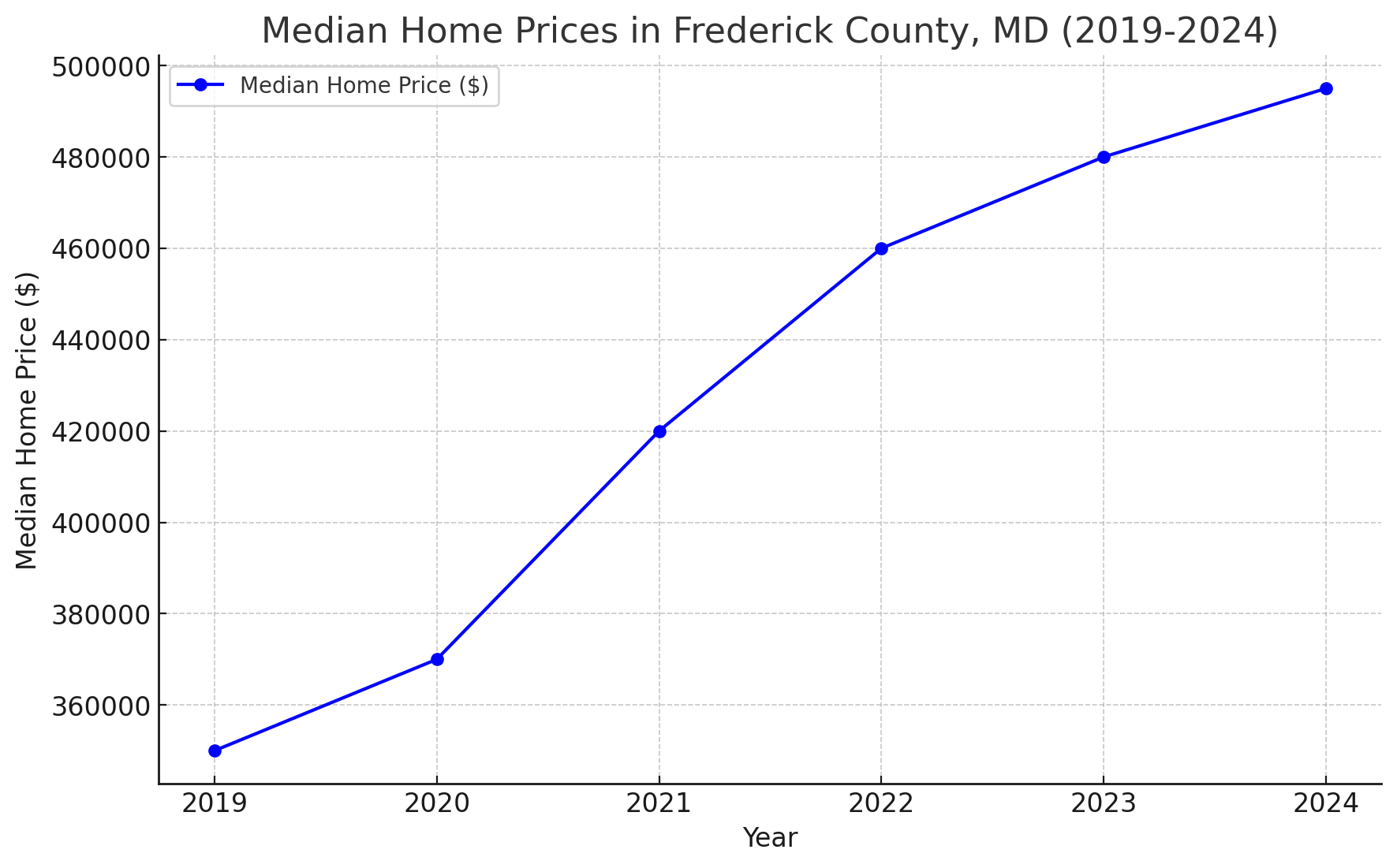

3. Home Price Trends: Locking in at Today’s Prices

Home values in Frederick County have shown steady appreciation over the past few years. While prices may stabilize or fluctuate slightly in the short term, the long-term trend generally shows rising property values.

If mortgage rates do go down, it’s likely that more buyers will re-enter the market, leading to increased competition and potentially higher prices. By purchasing now, you’re locking in today’s price, and if rates decrease in the future, you could refinance to benefit from the lower rate. This combination of current negotiating power and future refinancing potential makes now a compelling time to buy.

The Bottom Line: Why Waiting Might Not Be Worth It

To sum it up, here’s why acting sooner rather than later could work in your favor:

- Less Competition: Many buyers are holding off, creating a window with less competitive bidding.

- More Negotiating Power: With numerous price reductions on the market, you have room to negotiate a favorable deal.

- Future Refinancing Potential: You can secure a home now and refinance later if rates decrease, maximizing your long-term savings.

If you’ve been on the fence about buying, consider taking advantage of these unique market conditions. Reach out today to discuss your options and see how you can make the most of the current market in Frederick County, MD.

Recent Posts