Hidden Influences of Home Financing: Thinking Beyond Interest Rates

It’s natural to want to wait for the “perfect” interest rate, but focusing solely on rates might mean missing out on other opportunities to maximize value. Here’s why timing the market for rates isn’t always the best approach—and what you can do instead:

Why Timing Rates Could Be Risky

-

Rates Can Be Unpredictable

Rates fluctuate based on market conditions, and waiting for a specific rate could mean delaying your purchase indefinitely—or worse, missing out if rates go higher. -

What You Can’t Control

The housing market, inflation, and economic factors all influence rates, and waiting may not lead to significant savings. -

What You Can Control

Your timing and strategy! Instead of focusing solely on rates, there are other ways to increase your buying power and find value in today’s market.

Other Factors That Can Make a Huge Difference

-

Buying During Lull Times of Year

- The market tends to slow during the winter months or holidays. Fewer buyers mean less competition, giving you more negotiating power.

-

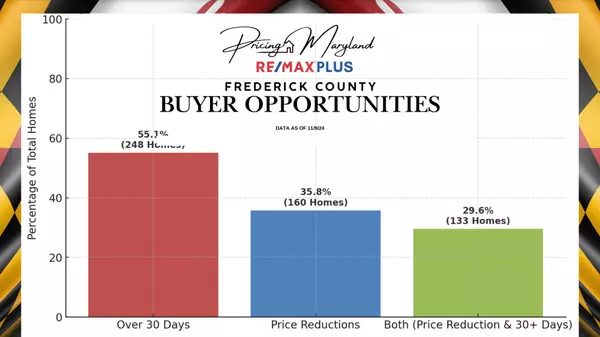

Looking for Homes That Are Sitting on the Market

- Homes that have been listed for 30+ days may be priced too high initially or overlooked by other buyers. These sellers are often more open to price reductions or creative offers.

-

Creative Strategies for Long-Term Value

- Buy a Duplex or ADU Property: Purchasing a home with a second unit can lower your monthly payment and even help you qualify for a larger loan. You can live in one unit and rent out the other for additional income.

- Seller-Paid Rate Buydowns: Some sellers may be willing to pay to lower your interest rate temporarily, making monthly payments more affordable.

- First-Time Buyer Programs: Explore grants, down payment assistance, and loan options designed to help reduce costs.

The Big Picture

Instead of waiting for the “perfect” rate, consider the long-term value of your investment. Refinancing is always an option if rates drop later, but opportunities like a price reduction, motivated sellers, or additional income from a property with an ADU can have a much bigger impact on your financial future.

Recent Posts