Feel trapped in real estate's "Golden Handcuffs"? Here’s How Your Equity Can Set You Free

Feel trapped in your real estate's "Golden Handcuffs"? Here’s How Your Equity Can Set You Free

If you’re like most homeowners, you may be holding onto a low mortgage rate, thinking it’s your greatest asset. But what if the real opportunity lies in the equity you’ve built? While interest rates have kept many homeowners in place, property values have surged, and with them, home equity has grown substantially.

What Are Real Estate’s Golden Handcuffs?

The term golden handcuffs is often used to describe financial incentives that keep employees tied to a job. In real estate, it refers to homeowners who feel financially “trapped” by their historically low mortgage rates. With interest rates rising, many homeowners hesitate to sell because they don’t want to give up their low monthly payments. However, this mindset may be preventing them from unlocking greater financial opportunities through their growing home equity.

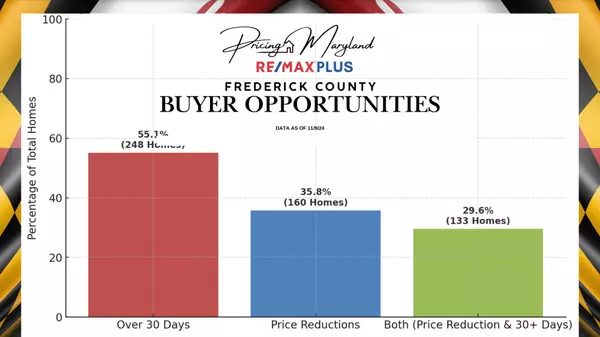

Many homeowners today are experiencing financial freeze, focusing solely on their mortgage rate while overlooking the financial flexibility their home equity can provide. In Frederick County alone, the average sales price jumped from $394,923 in 2020 to $524,874 as of December 2024. Nationwide, homeowners gained an average of $60,000 in home equity in 2023, with even greater increases in competitive markets.

Instead of staying locked in by an interest rate, homeowners should consider how to use their growing equity to take the next step toward financial freedom.

The Overlooked Asset: Your Home Equity is More Valuable Than Your Interest Rate

Many homeowners are so focused on preserving their historically low mortgage rate that they are ignoring an even more valuable factor: the equity they’ve built over time.

For example, a homeowner who purchased a home for $400,000 at a 3% rate might now own a property worth $600,000 with a loan balance of just $250,000. While the low rate reduces interest payments, the $350,000 in equity is the real financial advantage.

This overlooked equity can offer financial freedom in ways that simply keeping a low mortgage rate cannot. Whether it’s downsizing for retirement, relocating for a new lifestyle, or reinvesting in an income-generating property, the ability to use equity strategically can be a game-changer.

How Equity Creates Financial Freedom

Equity—the difference between a home’s current value and what is owed—has grown significantly for most homeowners. This means:

-

They are sitting on hundreds of thousands of dollars in real estate wealth.

-

They have more financial flexibility than they realize.

-

They can leverage this equity to buy their next home with a sizable down payment, reducing the impact of today’s higher interest rates.

-

They can use their equity to invest in opportunities that build long-term wealth.

Let’s Find Out How Much Equity You Have

Don’t let your fixed interest rate fix the rest of your life. You have other options—let’s explore them! Book a consultation with me and we can see what options are best for you in today’s market.

Contact me today, and let’s unlock your home’s potential!

Recent Posts