Are You Sure Your Home Buying Price Range is Accurate? Don't make this costly mistake.

Are You Sure Your Home Buying Price Range is Accurate? Don't make this costly mistake.

If you're serious about buying a home, the first step isn't browsing listings or scheduling showings—it’s getting pre-approved. Too often, buyers start looking at homes before understanding what they can actually afford, only to realize later they’ve wasted time chasing properties out of their price range.

Why Guessing Your Budget is a Costly Mistake

Online mortgage calculators can be misleading. They might give you a ballpark figure, but they don’t account for local property taxes, insurance costs, HOA or condo fees, or the nuances of different loan programs. Your mortgage payment isn’t just principal and interest—it includes property taxes and insurance, while HOA or condo fees are also factored into your overall approval amount.

Interest rates also aren’t one-size-fits-all. The rate you qualify for depends on your credit score, loan type, and other financial factors. Some buyers assume they can afford a certain price range, only to discover their debt-to-income ratio (DTI) disqualifies them from their target budget. Your DTI is the percentage of your income that goes toward existing debt—think car loans, credit cards, student loans. A high DTI can reduce your borrowing power even if you have great credit.

Down Payment & Closing Costs—More Than Just the Sales Price

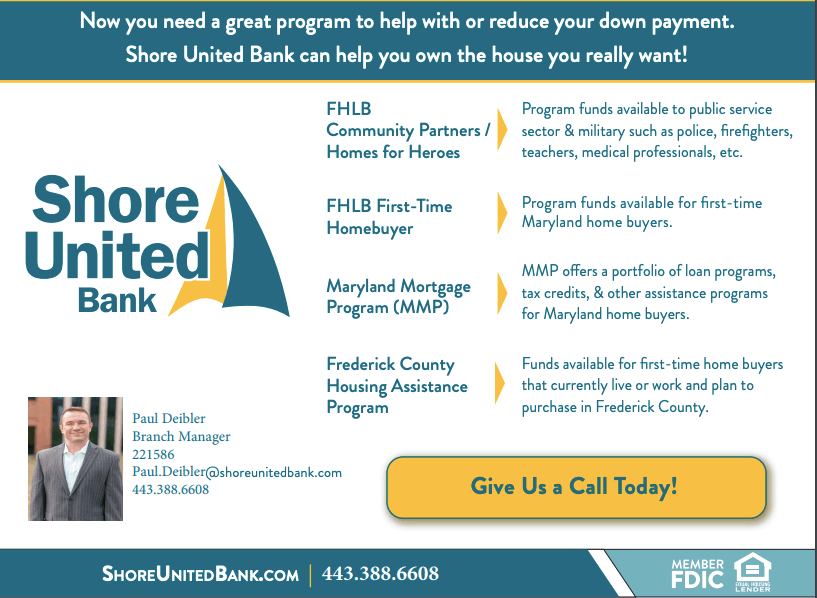

Your down payment can dramatically change your monthly payments. Many first-time buyers assume they need 20% down, but options exist for as little as 3%—and for veterans, even 0%. However, how much you put down affects your loan terms, monthly payments, and whether you’ll need mortgage insurance.

Closing costs are another reality that catches buyers off guard. In Maryland, these can add 3.5%–4% of the purchase price to your upfront costs. The good news? Local lenders often have programs to help offset these expenses, which is another reason why talking to a lender early is so critical.

But Won’t a Pre-Approval Hurt My Credit?

A common myth is that getting pre-approved will significantly damage your credit score. Yes, a lender’s credit check may temporarily lower your score by a few points, but it rebounds quickly. More importantly, once you apply with one lender, you have 45 days to apply with others without further impact. This allows you to compare loan estimates and find the best terms without penalty.

Some buyers hesitate to get pre-approved too early because they don’t want their credit pulled twice. Here’s the reality: pre-approvals last 60–90 days. If your search takes longer, your lender will need to update your documents and possibly rerun your credit. But what’s worse—having to refresh your pre-approval, or spending months searching for homes in the wrong price range? The answer is obvious.

Bottom Line: Get Pre-Approved First

Before you tour a single home, sit down with a lender. Get a clear picture of your budget, your loan options, and your expected monthly costs. You’ll save time, avoid unnecessary heartache, and be taken more seriously by sellers when you’re ready to make an offer.

Don’t guess. Get the facts. Get pre-approved.

Click here to get started.

Recent Posts